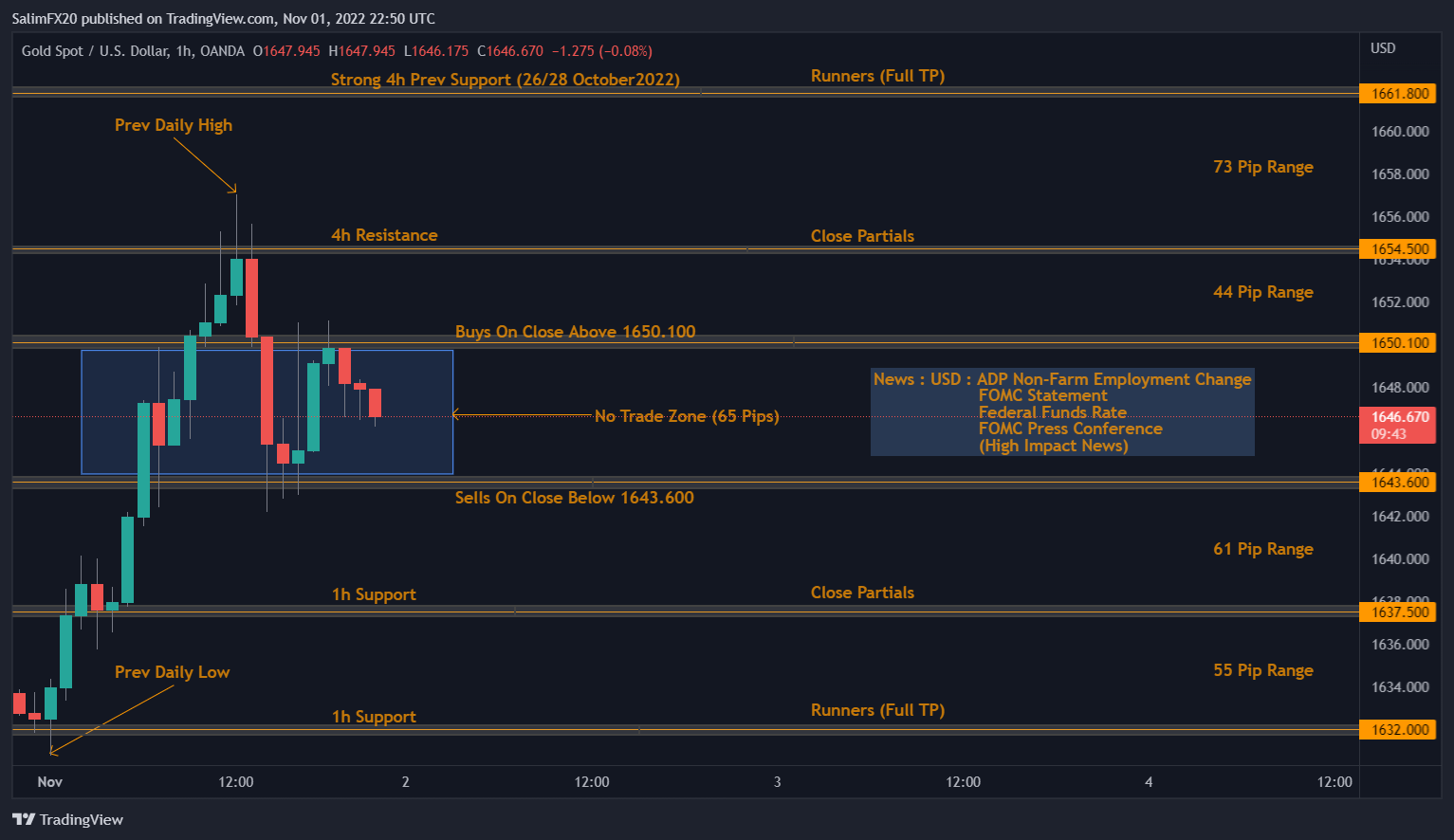

– Buys on close above 1650.100 targeting 4h Resistance at 1654.500, Leaving Runners to the Strong 4h previous Support formed on Wednesday the 26th + Friday 28th October 2022 at 1661.800.

– Sells on close below 1643.600 targeting 1h Support at 1637.500, Leaving Runners to the next 1h Support formed at 1632.000.

– High Impact News for the US Economy starting with ADP Non-Farm Employment Change 15min after New York Session opens forecasted at : 178k / Previous : 208k. Later on we have FOMC Statement, Federal Funds Rate forecast an increase to 4.00% from 3.25%, 30min after we have FOMC Press Conference as Chair Jerome Powell first read the FOMC statement then questions are opened to the Press, high Volatility expected during the Press Conference.