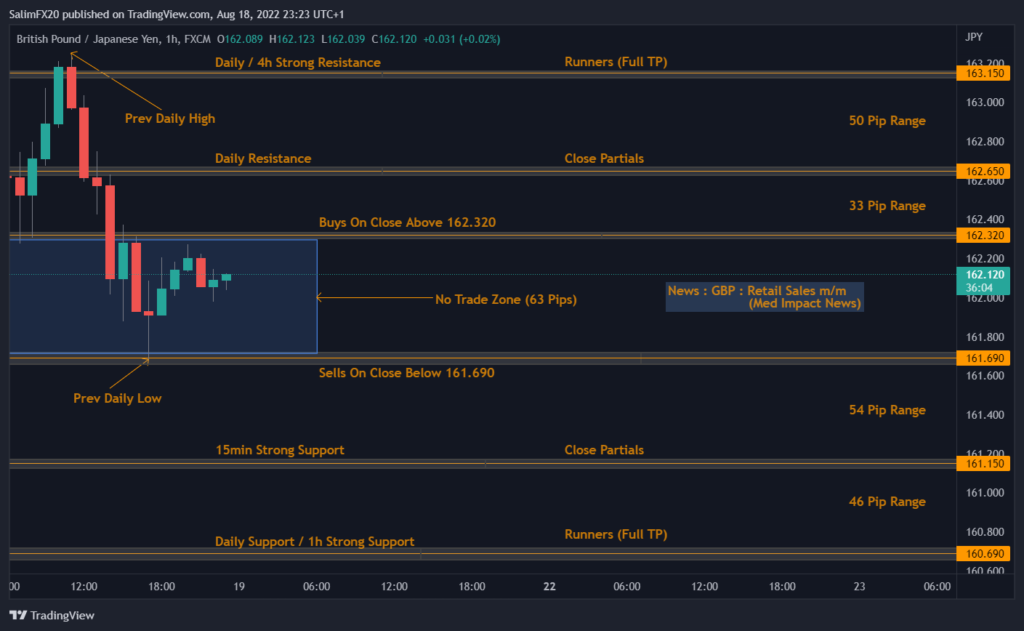

– Buys on close above 162.320 on the break of the previous 1h Resistance targeting the most recent Daily Resistance formed on Thursday’s trading Session at 162.650 leaving Runners to Daily / 4h Strong Resistance at 163.150.

– Sells on close below 161.690 on the break of the previous Daily Low targeting 15min Strong Support at 161.150 leaving Runners to Daily / 1h Strong Support at 160.690.

– Strong data report on Retail Sales for the UK Economy forecasting -0.2% / Previous: -0.1% as high cost of living is hitting the Retail Sales due to high inflation (Currently at 10.1%), Data to be released 1h before London Session opens.